Cultural Economy

In the old days, before about 1890, there was no field of economics. There was only political economy, rightly reflecting the link between institutions and laws and the incentives they created. As Acemoglu and Robinson pointed out in Why Nations Fail, what we call economics arises from the interplay of culture and institutions, and to think that economics is the same for all is to think poorly.

I want to point out some of the ways in which economic thinking can differ across cultures, and explain some of what we see in development in China, and in foreign countries with Chinese companies.

Economic issues are necessarily paramount for any national leader. Right now, both Mr. Xi and Mr. Trump derive their legitimacy from promises to achieve national greatness again, and for both, this fervent hope has much citizen – that is, cultural - support. For Trump, the political slogan is Make America Great Again; for Xi, Made in China 2025, or perhaps, Socialism with Chinese Characteristics for a New Era.

In China, this promise is more than a political slogan – more than, it’s the economy, stupid. For Xi and CCP, the promise of development is at the heart of the promise to the Chinese people. All other values are to serve that purpose. That has been CCP policy since inception. The CCP Constitution is pretty clear –

In leading the cause of socialism, the Communist Party of China must persist in taking economic development as the central task, making all other work subordinate to and serve this central task.

Chinese development internally has been one of the world’s great stories – from extreme deprivation and depression to dual tier markets and township village enterprises and some land rights and property rights and competition law and insurance and stock markets and financial markets of all kinds. The infrastructure miracle is the obvious sign of change for investors and foreigners alike. But China doesn’t seek to export its development model. It is understood that China is sui generis - except for infrastructure, where the universal model always seems to be, if you build it, they will come.

Many revenue-generating infrastructure projects within China seem structured as loss leaders for economic development, to the benefit of the local party chief. There just isn’t any way for the completed project to throw off enough cash to pay for all construction and development and operating costs. One sees this in some expressways, subways, some high speed train lines, some airports and ports. The completed projects are beautifully appointed white elephants. How can this go on, year after year, across China? Where is the ROI calculation? Where is the money coming from? Who is eating the losses?

One has to understand the difference in ways of understanding economics in China and the west. This means understanding how culture drives incentives. Economic interpretations are culturally implanted. Thinking about long and short term can be different. Thinking about goals can be different. What is rational can be different. Let me give you some examples. First, from the savings side of the market.

Example 1 – bank savings

It is about as fundamental an economic idea as there is. When returns go up, people invest more and restrain consumption. Interest rates go up, people will save more, and restrain consumption. At the national level, macroeconomists have to figure out the impact of potential changes in interest rates, exchange rates, employment rates and investment. What will people do? And while every situation has its own special character, when one has been making judgments for a while, one gets a feel. So it was with some surprise that I saw Chinese policy makers discussing the impact of a rise in interest rates on savings. This was at a time that policy makers were debating whether to allow rates on bank savings to rise, giving citizens a bit more of a return on their money, commensurate with growth in the economy, and ever-so-slightly slowing demand for money from developers and governments.

But what’s to discuss? If interest rates go up, people put more money in the bank. That is how the world works.

But maybe not always. Our standard assumption, seldom noted, is that people are unconstrained in their choice to save or consume – that is, people are free to alter their spending or savings pattern as they wish. For many savers in China – for most of us in the real world - that is not true. You know the deep cultural importance attached to education in China. Families, grandparents, will sacrifice mightily to save enough money to send their star student off to college, maybe high school, in America. That may take extreme savings over a fifteen year period, but the investment is considered worth it. If the grandparents have a defined monetary goal - $50,000 in fifteen years, then savings of $240 per month are required if interest rates on bank savings are 2%. Returns in the real economy might be 7%, or 10%, but savers never see those returns. But suppose policy makers allow interest rates to rise – say to 5%. Then monthly savings of $193 are required to meet the future monetary goal, and perhaps grandma and grandpa can eat a little better, or afford the medicine they sacrificed for the cause. Current consumption instead of savings. The policy question is then, will they spend the extra $47 per month, or save it? If you are a policymaker, how do you think about the goals of savings? If you raise interest rates, will people put more money in the bank - or less? Without some handle on the cultural features of savings, you don’t know. And don’t let libertarians or advisors whose understanding of economics includes no psychology or human behavior tell you that economics has no cultural biases.

Example 2 – trust and good faith

Getting to Yes is the well-known book on negotiating by Roger Fisher and William Ury. I think everyone in the world who has ever taken a negotiation course has read this book. In it, Fisher and Ury lay out the major principles for successful business negotiating over time – focus on interests, not positions; try to invent options for mutual gains; quantify or be clear about goals and measures of success. They are well aware that some negotiators lie, cheat, and distract, for the sake of the bargain. But a general assumption in the US at least, is that the parties are negotiating in good faith – meaning a sincere intention to deal fairly with others. In American contract law, good faith means that one party will not act so as to destroy the ability of the other side to receive intended benefits.

That is decidedly not a good assumption in negotiating in China. The best known classics of war, and negotiating, in China are san shi liu ji, 36 Stratagems, and sun zi bing fa, the Art of War, by Sunzi. Both are studied closely by students and businessmen. Both emphasize deception, misdirection, and secrecy in dealing with the enemy.

With apologies to Chinese businessmen who have been highly successful by acting in open and principled ways with Chinese and foreigners, good faith is not a good assumption. Stories about misunderstandings in completed negotiations or the irrelevance of a signed contract can be attributed to cultural differences. This is part of learning the turf. But other problems, such as quality fade, theft of molds and IP, even kidnapping of American business people over payment disputes, are not cultural, but simply describe dishonest behavior. This, when negotiations in China are designed to take extra time in order to build relationships.

Even within a company, growth plans can be secret, the province of only the owner. Survival and growth in the market is akin to warfare. Sunzi tells us that deception is a necessity, even when dealing with subordinates.

5:19 Energy - Thus one who is skillful at keeping the enemy on the move maintains deceitful appearances, according to which the enemy will act.

6:9 Weak Points and Strong O divine art of subtlety and secrecy! Through you we learn to be invisible, through you inaudible; and hence we can hold the enemy's fate in our hands.

11:35,36 The Nine Situations It is the business of a general to be quiet and thus ensure secrecy; upright and just, and thus maintain order… He must be able to mystify his officers and men by false reports and appearances, Literally, "to deceive their eyes and ears"and thus keep them in total ignorance.

Per Sunzi, and per common practice, implementation in business or government can then be undertaken without clarity for underlings. It is a powerful tool in both business and government. Clarity for CCP underlings is not required when leaders are the only source of truth and know the goal. For leaders, lack of clarity permits use of oppression when unclear laws are violated. For citizens, lack of clarity requires self-censorship in word and deed. In business, proper use of unclarity and deception might induce the “other side” in any negotiation to reveal its secrets or preferences, or even act rashly when confronted with apparent delay or indecision. In the best of times, trust in good intentions is limited. There is no good faith in the absence of relationship built over time.

This is both a powerful tool and a crippling handicap in Chinese international infrastructure deals. Initial lightning speed and mystery in decision-making overwhelm opposition, but in the longer term, substantial good will is lost. We dealt with that problem in the US - the model of government action as "decide, announce, defend" became too costly in time and lawsuits. Better is "discuss, decide, build." But that isn't necessary in an authoritarian state.

Example 3 – infrastructure investment

We are all astounded by the sheer extent of Chinese infrastructure investment in the last ten years. The stimulus in 2008 was far larger, as a per cent of the economy, than the American one. But those of us with some boots on the ground are also astounded at the sheer wastefulness of some of that investment. We know that these projects are financed by bank loans, and those loans come due in three years or so – banks are not long term lenders. And aside from projects taking three years to build, we have the experience of (theoretical) revenue generating projects that cannot possibly generate enough money to pay for construction and interest and operations. No way. A favorite example of mine is a new expressway built from Shanghai to Pudong, where the international airport is located, completed about 2008. My first trip to the airport in 2008 was uneventful, for the simple reason that there were hardly any other vehicles on the road for 30 miles. I mean, nearly zero. At the time, this was a new expressway, and I suppose the information of its availability could have been scarce. Possibly. But I used that expressway at least twice a year for eight years, and the level of congestion hardly changed, anytime of the day or night, weekend or not. Nearly no traffic.

There were simply too many other competing routes to the airport. Big mistakes are possible everywhere in the world on infrastructure projects, the US being no exception, but we see similar stories repeated across China. Transportation economists and engineers work pretty hard to forecast traffic and revenues, consider alternative routes and toll costs, and while the results are less than perfectly accurate, they are a decent guide to the investment decision. But voters in the US, not to mention bond holders, would be more than a little exercised if their investment produced no ability to repay after so much planning. Is there a different calculus in China?

Chinese planners have the means to make perfectly rational decisions about such matters. So how can such revenue-short projects get built over and over again - aside from the pressure on local officials whose promotions depend upon generation of a target level of GDP in their three or five year term, and the need to spend following the huge 2008 stimulus. Is the investment planning really for a twenty year horizon, at which time future demand will be sufficient to pay off the loans? (I did transportation planning and economics work for some years. There is no twenty-year projection of expressway use that is worth the spending of electrons to produce).

There is a way to make sense of these deadbeat projects, whether they are expressways, high speed train lines, airports or commercial ports. And there is a way to understand the difference with western decision-making. Given that the real decision is a political one, even more so than in the US, the trick is to consider than the long term doesn’t really matter. A little bit of the cynical Wall Street IBG, YBG – by the time it matters, I’ll be gone, you’ll be gone.

How to understand this? A simple chart from econ 101 should help. A key point to understand is that the construction contractors, lenders, and local government investors in these projects are either government entities or heavily government-compromised. While many big SOE make big profits, the companies can have political goals as well. This means that they are not strict profit maximizers, in basic econ terms. This also means that someone will take care of them in times of trouble.

Many, if not most, expressway projects in China are constructed by SOE as what we call B-O-T projects – build, operate, and transfer. The concept is that the SOE contractor borrows the money to build the expressway, and receives tolls for a period of time – twenty years, let us say – to repay the loan and provide profits for the contractor. At some point in the future, the right to receive tolls reverts to the original government owner of the expressway.

But what happens when tolls are nowhere near enough to pay back loans? This is a rather common problem. Or would be a problem in the US. Two particular ideas of “capitalism with Chinese characteristics” pertain here.

- Loans for construction are bank loans, but the borrower may include local governments where the branch of the lending bank is located and even though loans come due every three years or so, the loans can be rolled over again … and again. That is part of what the SASAC (State Asset Supervision and Administration Commission) does – help borrowers roll loans among different local lenders. At some point in the future, someone will have to deal with these problem loans – perhaps one of the “bad banks” created for that purpose. But that is not now. Just FYI, my favorite expressway to Pudong is now being handled by the one of the SASAC units in Zhejiang.

- But wouldn’t the construction companies get cold feet, or nervous about not receiving planned income or having to repay the banks? Not necessarily. In many recent cases, the borrower is actually a partnership between local governments and an SOE contractor. And here is a neat trick, that could – theoretically – explain how the contractor can sleep at night.

How do regular retail stores decide to close for the evening, or the season? How does a Starbucks decide to close at 10:00 PM, and then, miraculously, reopen at 6:00 AM? Why not stay open all night? Or, the ski lodge – open for five months a year, then close for seven months, and reopen? How can this work, with mortgages and taxes and rents to pay?

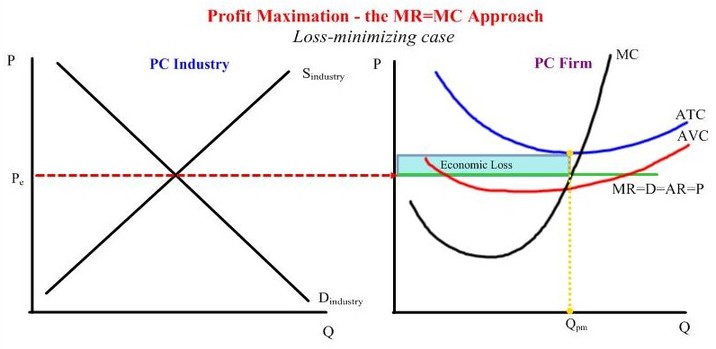

The econ 101 answer is that businesses will shut down temporarily when revenues cannot cover average variable costs – for Starbucks, the cost of salaries and cups and coffee and heat or a/c. If these variable costs can be covered, then the store will remain open. If not, then close down and reopen when there will be enough customers – in the morning - that you can reliably cover average total costs. In the morning, you will begin taking in enough revenue to cover operating costs and the bank loans and interest and rent and insurance and other fixed costs and make a profit. In the short run, you stay open if you can cover average variable cost. In the long run, you have to cover all the other costs as well, but that is the long run. This is also the situation for the Chinese expressway with little traffic.

Stay with me on this, and the graphic representation will help.

In the figure below, you can see that the price P of the good is still above average variable cost AVC at the quantity Q being sold. In this case, the seller should remain open, as long as the seller is confident that sales will pick up at some point in the near future (the morning) and sales quantities will then be at or above average total cost ATC. Think of the price here as the price of the average sale at 2:00 AM; by 11:00 AM, both the average sale and the quantity sold will be greater, putting the company into a profitable situation again.

- Even though the firm is not earning any economic profit, it is earning enough to pay their laborers (AVC), and thus it incurs less loss compared to the whole of average fixed cost.

- In this situation, the company should continue producing the product.

- P = MR > AVC , P = MR < ATC --> point where MC = MR minimize its loss

- Economic loss = Q (ATC - P)

- When AVC < P < ATC, the firm can stay open as long as they can cover the AVC

- If a firm can cover all of the AVC and even part of the fixed costs, they will lose less than shutting down, as MR < ATC

- Shutting down would mean losing everything and still have to pay for fixed costs, while in the loss minimizing case, costs are still covered.

Source: Welker's Wikinomics

The same concept can apply to Chinese construction companies in BOT projects. Loan servicing costs don’t really matter. Someone, sometime, will deal with that, in the long run. If tolls from cars and trucks – and tolls are very high in China* – can cover operating costs – labor to collect tolls and trim bushes – then the project can remain open.

*Example – passenger car tolls for the 600 mile trip from Hangzhou to Jingzhou, in Hubei Province, are about 500 yuan, one way – say $75.

This is only a theoretical example. I don’t really know if this is the thinking behind expressway projects that will never make money with debt taken into account. More likely is the the leader at some point said, proceed, and at that point, money became no obstacle. And obviously some projects can pay their debts. You can see why big projects are often development projects, with revenues from related operations – retail stores, sales of apartments, rental from offices – rather than simply infrastructure projects. Just like the building of the transcontinental railroad in the US, where the railroads were given land to use for non-railroad revenue.

The example shows what could be a rationale for continuing to operate the expressway. And a positive spin on this story would be that to a much greater extent than in the US, Chinese infrastructure projects are expected to pay for themselves.

When they cannot pay for themselves, loans are, in fact, rolled over again and again. At some point, these projects with negative economic value must be recognized as such, and GDP will suffer as the project is written down to some value via sale to a third party, all the partners and the bank will need to take a big hit, or else someone – some government – will need to continually feed money into the project to cover debts. This process usually happens quickly in the US, in bankruptcy. In China, the process can take many years, but that is what the “bad banks” are for – to take the otherwise uneconomic projects and run them until they can be sold to someone or debt finally paid off by the Ministry of Finance. The current idea is to convert the bank debt into bonds owned by the banks, and let the banks sell the bonds to (haha!) foreign investors. Win-win!

Example 4 – stock investing

Stock markets were originally intended to accomplish two tasks – provide a source of funds for SOE, and “privatize” some of the risk. These efforts succeeded, and now most companies on the Shanghai stock exchange are SOE, with private funds supplementing a major government position, either ownership or management. Two way foreign and domestic stock market trade between Shanghai and Hong Kong has been allowed since 2014, and there is now an rmb clearing function in London, meaning trades can be settled in rmb outside of China. Now the government is pushing quite hard to get foreign investors directly into stocks and bonds in China.

My own somewhat cynical view is that this is not in the long term interest of Hong Kong or London – or foreign investors. As long as CCP controls markets in China – and Mr. Xi is reestablishing the “Party is fundamental in all markets” philosophy – markets will not receive the sort of information needed to function efficiently. Observe how much markets in China are affected by news reports or a speech by a particular high level official. And observe the somewhat herd-like behavior of Chinese in purchases – a good word from the government suggests safety and profitability in a nation critically short of widespread basic economic news, not to mention divergent views.

Michael Pettis does a superb job in pointing out the structure and pitfalls of China investing. He is one of the few China macroeconomic analysts with both western and Chinese investment trading experience, as well as the academic chops to put all in context. Those interested in China financial markets should not miss a posting, now hosted at the Carnegie Center for International Peace. Every post is rich.

Pettis writes most about overinvestment and the necessary macro adjustments, but his writing about the stock markets is also insightful. Writing in late 2013, he made an important point - The recent Nobel Prizes in economics suggest both that markets are efficient, and that they are not. In fact they are likely to be efficient under certain conditions and inefficient under others.

Pettis argues that stock markets can be efficient at allocating capital under some conditions and not others. He sees the need for an appropriate mix of three different kinds of investors, with different investment profiles, which he terms fundamental investors, relative value investors, and speculators.

It is now 2019. I don’t follow the Chinese stock market, and perhaps Pettis now has a different view. But the fundamental conditions seem unchanged to me, if not more destabilizing than they were in 2015 and before.

He defines the three segments as follows –

- Fundamental investment, also called value investment, involves buying assets in order to earn the economic value generated over the life of the investment. When investors attempt to project and assess the long-term cash flows generated by an asset, to discount those cash flows at some rate that acknowledges the riskiness of those projections, and to determine what an appropriate price is, they are acting as fundamental investors.

These investors are buying the long term trend of the economy, or the long term prospects for an individual company. They want good financial information on companies.

- Relative value investing, which includes arbitrage, involves exploiting pricing inefficiencies to make low-risk profits. Relative value investors may not have a clear idea of the fundamental value of an asset, but this doesn’t matter to them. They hope to compare assets and determine whether one asset is over- or underpriced relative to another, and if so, to profit from an eventual convergence in prices.

These investors are buying the shorter term trend in the market, and perhaps choosing among individuals stocks in one industry, based on what information they have.

- Speculation is actually a group of related investment strategies that take advantage of information that will have an immediate effect on prices by causing short-term changes in supply or demand factors that may affect an asset’s price in the hours, days, or weeks to come. These changes may be only temporarily and may eventually reverse themselves, but by trading quickly, speculators can profit from short-term expected price changes.

These investors are looking at price changes over a span of minutes, hours, or days. They respond to signals that are clearly not fundamental to the growth of the economy, such as insider behavior or political announcements.

Michael Pettis. The Difficult Politics of Economic Adjustment. China Financial Markets, November 11, 2013. Now at Carnegie Endowment for International Peace as When Are Markets Rational? Note – versions of this newsletter are available online, but for the most part they do not include this stock market analysis. The stock market portion of the post is at Naked Capitalism.

Pettis argues that stock markets in China are inefficient because the data necessary for fundamental investors – good macroeconomic data, honest financial statements, clear corporate governance – is lacking; and China has few value investors, because the conditions they need – ability to trade frequently and quickly at low cost, and ability to short securities – is also absent. Speculators, he says, trade against very short term trend information, and are unconcerned about long term market fundamentals for a particular company. China stock markets are dominated by speculators.

One could categorize these three investor types as having long, medium, and short term horizons. Each type of investor looks at different information or analyzes the same information differently, and an efficient market can result when all information is available on which to trade. Without a good mix of all three, markets lose flexibility, and don’t allocate capital well. The Chinese markets are necessarily dominated by speculators – roughly 80% of stocks are held by retail traders, mostly individuals. The top ten listed companies on the Shanghai exchange are SOE, and most of the companies and the values are in government owned companies. China has pension funds and insurance companies that can take a long term view; but even those industries cannot get access to trustworthy and general fundamental information on companies. As a result, markets can be very volatile.

Example from Financial Times, September 27, 2017 -

When China’s vice-minister of industry said this month that Beijing was considering setting a deadline to ban sales of fossil fuel-powered cars, most auto industry experts did not overreact. The official did not offer any timetable, and rich countries such as Britain and France have set distant deadlines of 2040. Judging by the market reaction in Hong Kong, however, investors could be forgiven for thinking the statement was a bombshell. Shares in BYD, China’s largest producer of electric vehicles, surged to a record that day and are up more than 60 per cent this month. After BYD’s chairman speculated China’s deadline could be 2030 — in what experts said was more of a lobbying effort than a prediction — shares in the group’s separately listed mobile-handset unit also hit a record, despite the fact the company is not even involved in cars.

Not even involved in cars.

Even today, 80% of the listed companies on exchanges are SOE. There can be little investor confidence in any market data, from government or an individual company. Pettis notes that even credit decisions must become speculative, because when bankruptcy is a political decision and not an economic outcome, lending decisions are driven not by considerations of economic value but by political calculations. See the example of Pudong expressway construction above.

There are plenty of other ways in which "economics with Chinese characteristics" is different from that in the US - some of those ways make much more sense than what we think of as normal economics. I thought it would be fun to point out some differences - for good or for ill - that could lead to cultural, institutional, and even economic change in the US. After all, we import just about everything else from China. Ideas may be next - after all, Mr. Trump and the GOP follow Mr. Xi and CCP in political philosophy in so many ways now. Lightning speed and mystery and decision-making for the oligarchs and financial instability - no infrastructure, so far, though.